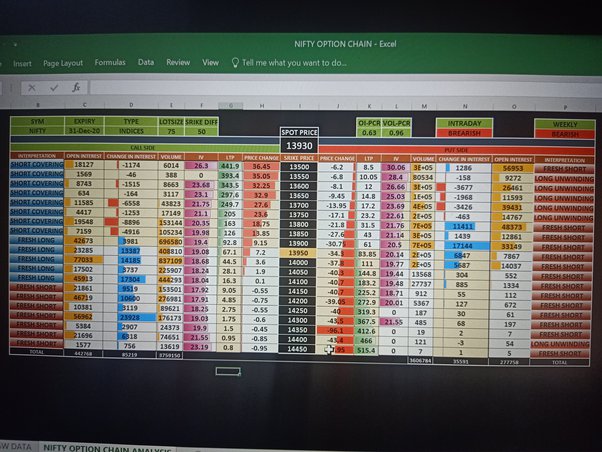

In the steadily developing scene of monetary business sectors, apparatuses that give significant experiences and improve direction are crucial. The Nifty option chain stands apart as a foundation for merchants hoping to open exchanges and achieve the Indian financial exchange. This thorough instrument offers an abundance of data that can direct dealers toward informed decisions, vital moves, and possibly worthwhile results. We should dig into why the Clever Choice Chain is much of the time thought about the way to trading achievement.

Understanding the Nifty option chain:

The Nifty option chain is a powerful portrayal of accessible choices contracts for the Clever 50 list, a benchmark for the Indian financial exchange. It catches both call and put choices, specifying different strike costs and lapse dates. This combined information engages brokers with a complete outline of market opinion, likely patterns, and value elements.

The Meaning of the Nifty option chain:

Market Opinion Investigation: By examining open revenue across various strike costs, brokers can measure market feeling. Higher open interest at explicit levels could show huge help or opposition zones, offering vital experiences for exchanging choices.

Value Development Markers: The Nifty option chain gives a brief look into potential cost developments. Centralization of open revenue at specific strike costs could recommend that the market is ready to move that way, helping brokers in anticipating cost patterns.

Risk Evaluation: Inferred instability (IV), a part of the choice chain, reflects market assumptions for future cost unpredictability. Understanding IV assists merchants with evaluating the potential dangers related to various choices and changing their trading techniques as needed.

Key Preparation: Furnished with data from the Nifty option chain, merchants can devise all around informed exchanging systems. They can utilize the connection between different strike costs and choice sorts to foster methodologies that line up with their gamble resilience and benefit goals.

Augmenting Trading achievement with the Nifty option chain:

Teach Yourself: Expert the fundamentals of choices trading, including call and put choices, strike costs, termination dates, open interest, and inferred instability. A strong comprehension frames the establishment for successful independent direction.

Specialized and Essential Investigation: Supplement the bits of knowledge from the choice chain with specialized and basic examination. This comprehensive methodology approves potential trading valuable open doors and refine your technique.

System Enhancement: Utilize an assortment of trading methodologies to take care of various market situations. These could incorporate directional systems, spreads, rides, or covered calls. Expansion mitigates hazards and improves your capacity to benefit from market changes.

Trained Execution: Adhere to your trading plan and keep away from hasty choices. Close to home exchanging can prompt misfortunes. A trained way to deal with executing your procedures is vital to reliable achievement.

Nonstop Learning: Markets advance, and trading systems need to adjust. Remain refreshed with market news, go to studios, read books, and gain from prepared merchants. Persistent learning guarantees you stay at the front of trading patterns.

All in all, the Nifty option chain is unquestionably a vital aspect for exchanging achievement. It offers experiences into market opinion, potential value developments, and chance evaluation, which are all significant for informed direction. Outfitted with this data, brokers can create successful techniques, take determined actions, and possibly expand benefits.