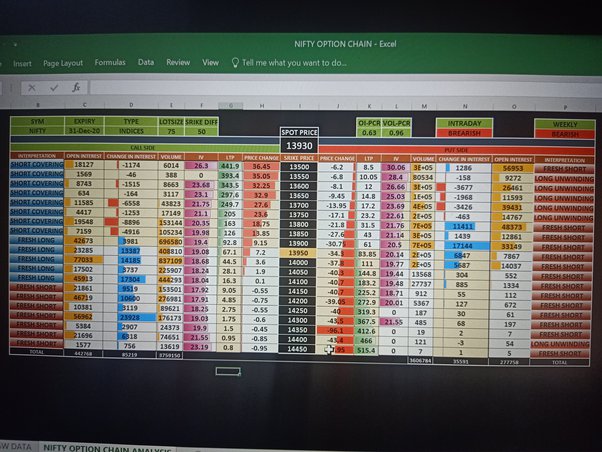

Setting up a business is difficult. People often get baffled at the pile of responsibilities that mount on them after they have set up their business. What most don’t understand is – managing a business means managing payroll with painstaking care. Because of a lack of awareness payroll management mostly come down to managing spreadsheets and taking care of data manually as per Charles Spinelli.

Charles Spinelli Gives An Alternative

As Charles Spinelli says, there is a way of dealing with payroll with skills. You need to educate yourself to avoid complications. Once you understand payroll, you can handle the requirements with care. If you can set it up properly, it can run smoothly and keep your employees happy. Your business will also run without any issue.

What Is Payroll Administration?

Payroll administration is the process of managing employee pays. From calculating working hours to distributing salaries, payroll management can help you make things better. It is more than just preparing a paycheck. It is about making sure your team gets paid accurately and on time. This is a non-negotiable aspect of any business. Whether you have one employee or fifty, payroll is a responsibility you cannot afford to ignore.

Why Payroll Matters In A Small Business

Proper implication of payroll affects more than just your employees and their financial status. It is closely related to your brand value and company reputation. If you keep making payroll errors, you could face fines, tax issues, or even lawsuits. However, if you do it right, you will be able to build trust, show professionalism, and create stability. This is why payroll is one of the first administrative systems new businesses need to create.

What Is Included In Payroll Administration?

Payroll includes a lot of aspects of a business. From tracking working hours and attendance to calculating pay and deductions payroll management takes care of everything. To implement this payroll system, you may need the expertise of a professional.

In-House vs. Outsourced Payroll: Which One Is Right For You?

There are two options when you are implementing the payroll system. You can hire a professional to work as your in-house payroll manager or you can outsource it.

Common Payroll Mistakes to Avoid

Payroll mistakes are common in startups. However, big enterprises also make payroll errors. One thing you need to remember is – payroll mistake can ruin everything for you. This is why, you need to take care of payroll management. Errors like missing payroll tax or not recording wages can lead to legal issues.

Lastly, if you are just getting started, payroll might seem like a huge thing says Charles Spinelli. But you must remember one thing – you don’t have to do it all at once. You can start with the basics and then proceed. Firstly, know your responsibilities, choose the right tools, and get into a regular routine. It does not matter what you are doing, running payroll from your home office or using a professional platform, make sure that your employees are paid on time. Because at the end of the day, payroll is not just about money. It is about your employees.