Have you ever considered buying stocks, however, observed yourself crushed by using complex phrases and concepts? If yes, then you’ve come to the proper area. In this weblog put up, we’ve curated a listing of critical pointers and hints for navigating the inventory market quite simply. Whether you’re a newbie or a skilled investor, we’ve given you included. Let’s dive into the share market!

Understanding the Basics

Before you make investments within the stock market, it’s important to recognize a number of the basics of the market. Here are a number of the important thing phrases and concepts you need to be familiar with:

Stocks

Stocks, also called equity or shares, are gadgets of ownership in an employer. When you buy a proportion of the stock share market, you end up a part-proprietor of the organization.

Stock Exchange

A stock alternate is a platform in which consumers and dealers come collectively to exchange stocks. The maximum famous stock exchanges in the US are the New York Stock Exchange (NYSE) and Nasdaq.

Brokerage Account

A brokerage account is an account you open with a brokerage company to shop for and promote shares. You can both alternate shares to your personal or rent a broker to do it for you.

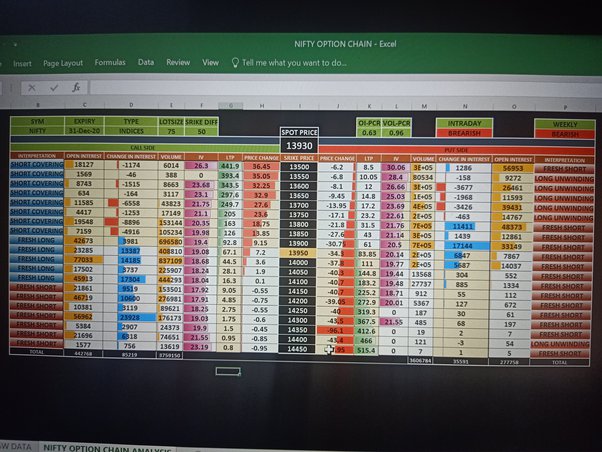

Technical Analysis

Technical analysis is a technique of comparing securities based on statistical developments and historical information. Here are a number of the techniques used in technical evaluation:

Charts

Charts are a graphical illustration of a stock’s price actions over time. They may be used to become aware of traits and styles inside the stock marketplace.

Indicators

Indicators are mathematical calculations primarily based on an inventory’s fee and/or quantity. Some common technical indicators encompass moving averages, relative power index (RSI), and moving average convergence divergence (MACD).

Fundamental Analysis

Fundamental analysis is a way of evaluating an enterprise’s economic fitness, which includes its sales, earnings, and balance sheet. Here are some of the techniques used in fundamental analysis:

Ratio Analysis

Ratio analysis involves comparing the key monetary ratios of a company to enterprise averages and/or its friends. Some not unusual ratios include the fee-to-profits (P/E) ratio, price-to-income (P/S) ratio, and return on fairness (ROE).

Qualitative Analysis

Qualitative analysis entails looking at an organization’s non-economic factors, such as its control crew, emblem recognition, and aggressive blessings. These factors can have an extensive impact on an agency’s lengthy-term achievement.

Trend Following

Trend following is an approach that entails analyzing marketplace tendencies and buying or selling based on one’s traits. Here are a few techniques utilized in trend following:

Moving Average Crossovers

Moving common crossovers contain using two transferring averages of various lengths to pick out when to buy or promote a stock. When the shorter shifting common crosses above the longer shifting average, it’s a buy sign. When it crosses beneath, it’s a promote sign.

Support and Resistance Levels

Support and resistance levels are zones wherein the charge of stock has traditionally observed aid or resistance. These stages can be used to pick out potential buying or selling opportunities.